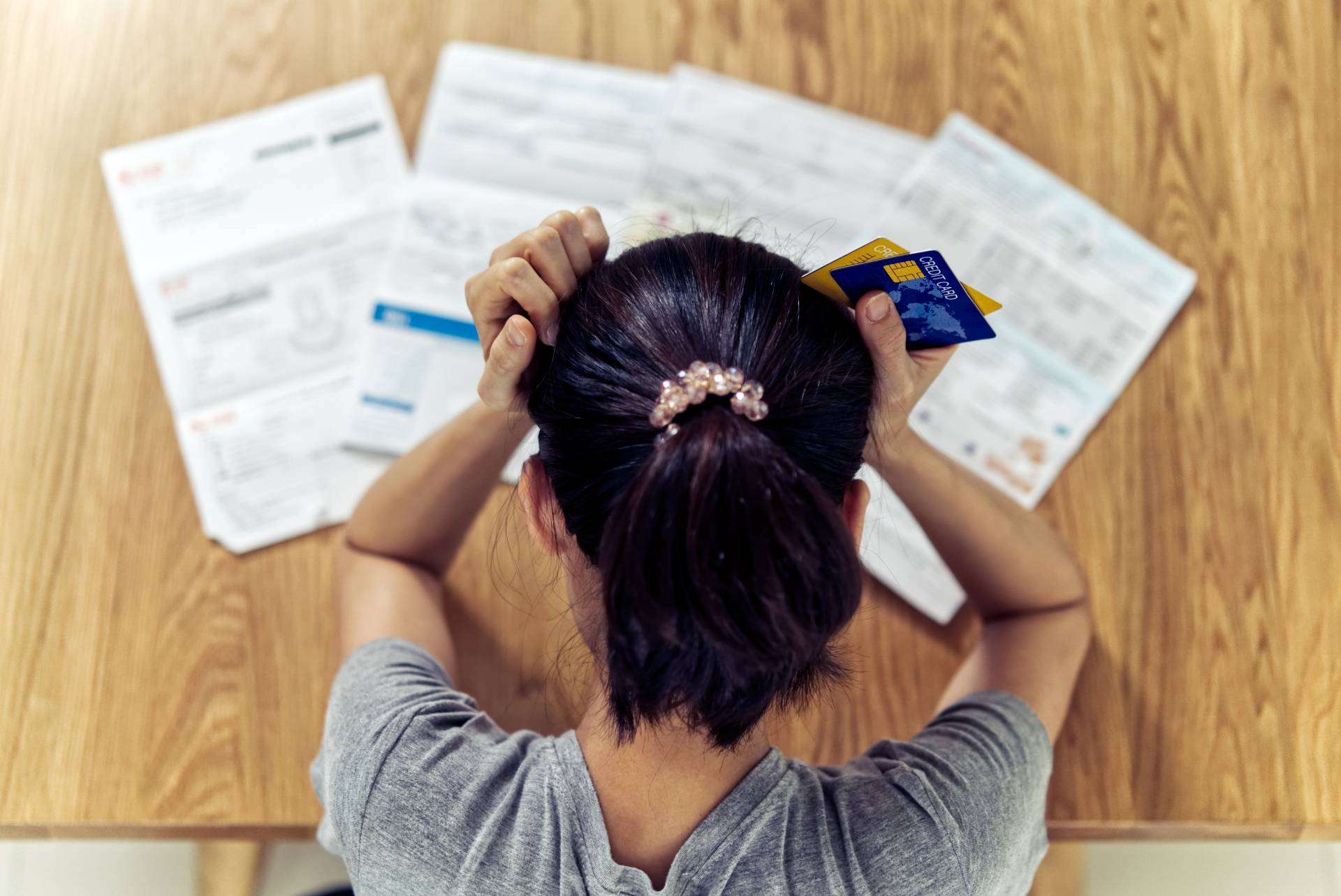

Have you suffered from insomnia since you applied for another loan to “pay off” your debts? Or have you left unopened bills on your table because you are doing “well”? Do you experience headaches or physical pain every time you think about your debts? You are probably overwhelmed by your financial problems and your body is asking for your help.

We will help you identify the most common afflictions associated with money and useful tips to overcome the pressure. Remember that your health comes first, and these problems can affect not only you, but your family, friends, and work as well. Your debts do not define you as a person, suffering mental or physical effects due to large debts or lack of financial stability is not worthy.

Denial

Are you leaving unopened bills over the table? You are paying the monthly minimum, but don’t have a real financial plan to deal with your debts? Are you constantly applying for new credit cards or loans to sustain your lifestyle?

If you answered yes to our questions, you are probably in denial. We understand it, denial is a common defence mechanism that helps us deal with the emotional impact of our actions and decisions. However, you may feel good right now, but denial will not fix your problem.

At one point, your income will not be enough to sustain your spending habits, or an unexpected life change can ruin your finances, making the whole process worse. The best way to deal with denial is to acknowledge your debt or loans! Identifying your fears and emotions about finances, and expressing those feelings are the first steps toward financial freedom.

Related Links: 3 Self-Help Tips For Coping With Debt

Stress

One of the first symptoms of the emotional and physical burden related to your debt is stress. You may experience headaches, muscle tension, or aches and pain when you are thinking about your debt. Lack of resources and financial stability also affects your emotional health, you may experience irritability, compulsive behavior (which increases the risk of impulsive purchases) and mood swings.

A prolonged state of stress can lead to more serious problems such as anxiety and depression. If you feel any of the symptoms mentioned above, seek professional care. Also, let us improve your financial situation and create a plan to achieve your financial freedom.

Related Links: Emotions Surge with Debt

Anxiety and Depression

We associate safety and even success to money, and the lack of it can increase your anxiety. Thinking about unpaid bills, large loans, and loss of income can trigger physical symptoms like muscle tension, fatigue, insomnia, increased heart rate, and even panic attacks.

These symptoms may be aggravated over time if you are not treated by a specialist, leading you to depression, causing even more distress such as feeling hopeless, self-loathing, changes in your appetite, and more. We want you to regain control over your financial situation and help you to overcome these feelings. Seeking professional advice, opening up about your situation with trusty family or friends, and creating a plan will make a big difference in your mental health. Furthermore, you need to go easy on yourself and focus on the aspects you can control now.

At 4 Pillars our clients say that our services not only provide a debt-free life but also emotional stability and well-being. We offer you a FREE consultation, so you can start building the life of your dreams now.