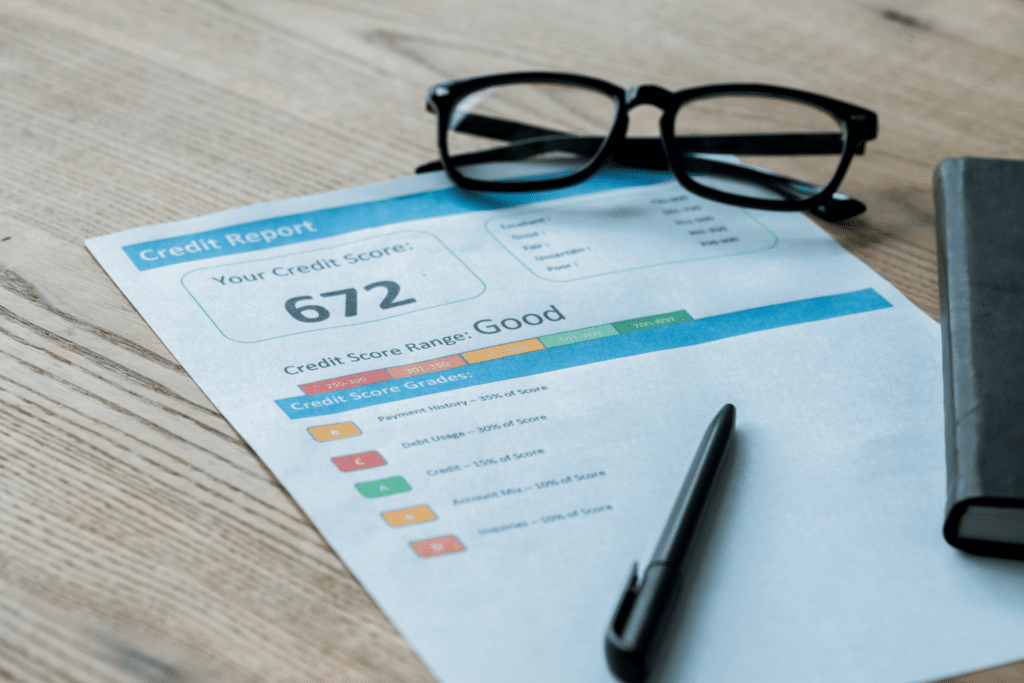

Unlocking the Secrets of Your Credit Report: How to Improve Your Score in Alberta

Your credit report is one of the most important tools in your financial toolkit. It provides a snapshot of your credit history, which lenders use to determine your creditworthiness. Understanding what’s included in your credit report and how to use it effectively is essential for maintaining a healthy financial life, especially when it comes to […]

Back-to-School Budgeting: Managing Education Expenses and Debts

As the back-to-school season approaches, parents and students alike face the challenge of managing education expenses and potential debts. With the rising cost of tuition, textbooks, and other school-related necessities, budgeting effectively becomes crucial. This blog provides tips on back-to-school budgeting, managing education debts, and the role of credit counselling in Alberta, particularly in Edmonton. […]

Debt Solutions for Edmonton Residents

Managing debt can be a challenging and stressful experience. However, residents of Edmonton have access to a variety of innovative debt solutions that can help them regain control of their finances. In this article, we’ll explore some effective debt solutions tailored for Edmonton residents, including debt consolidation, debt counselling, and other debt-relief options. By understanding […]

Debt-Free Living: Is it a realistic goal?

Living debt-free is a goal that many aspire to but often consider unattainable. With proper guidance and planning, however, achieving debt-free living is within reach. In this article, we’ll explore how debt-free living can be a realistic goal and the steps you can take to reach it. Understanding Debt-Free Living Debt-free living means having no […]

4 Pillars Guide to Summer Financial Health Checkup

Summer is the perfect time to take a step back, relax, and assess your financial health. At 4 Pillars, we believe that regular financial checkups are essential to maintaining financial stability and achieving long-term goals. In this guide, we’ll walk you through a comprehensive summer financial health checkup, focusing on credit counselling and credit rebuilding […]

How to Find Reliable Debt Help in Alberta

Managing debt can be a daunting experience, but finding the right help can make all the difference. If you are looking for reliable debt help in Alberta, you’re in the right place. In this article, we will explore various debt solutions available in Alberta and how Alberta debt counselling from 4 Pillars can provide you […]

Most Common Debts Among Canadians

It has never been easier to have access to credit, especially in a country like Canada. Even if that accessibility is linked to many benefits, it also carries a lot of disadvantages for Canadians. Did you know that the average debt held by Canadians is $23,035? And that number is even higher when you are […]

How To Calculate Your Net Worth And Why Is Important For Your Debt

Have you ever heard of the term net worth? Do you know how it can affect your debt? Or even your business? We will solve all your doubts and clarify some important points that surround your net worth. You will be able to track your financial health, illustrate your progress, and pay off your debt. […]

Make your financial goals for 2016

New Year’s is not just the time for freshness, newness and resolutions, it is also THE best time to review your financial situation and set your financial goals for 2016. Sure there are tons of articles on financial goals, but here’s a fact – everyone has a different situation – hence you’re better off making […]

8 questions you should ask yourself before paying that debt

1. Is it an official Collection Agency? Ordinary, you won’t have a thug banging down your door and asking you to pay a debt; that only happens in films. Whoever contacts you from the collection agency should be asked to show some identification and a Collection Agency License. If they don’t have one on them, you can […]