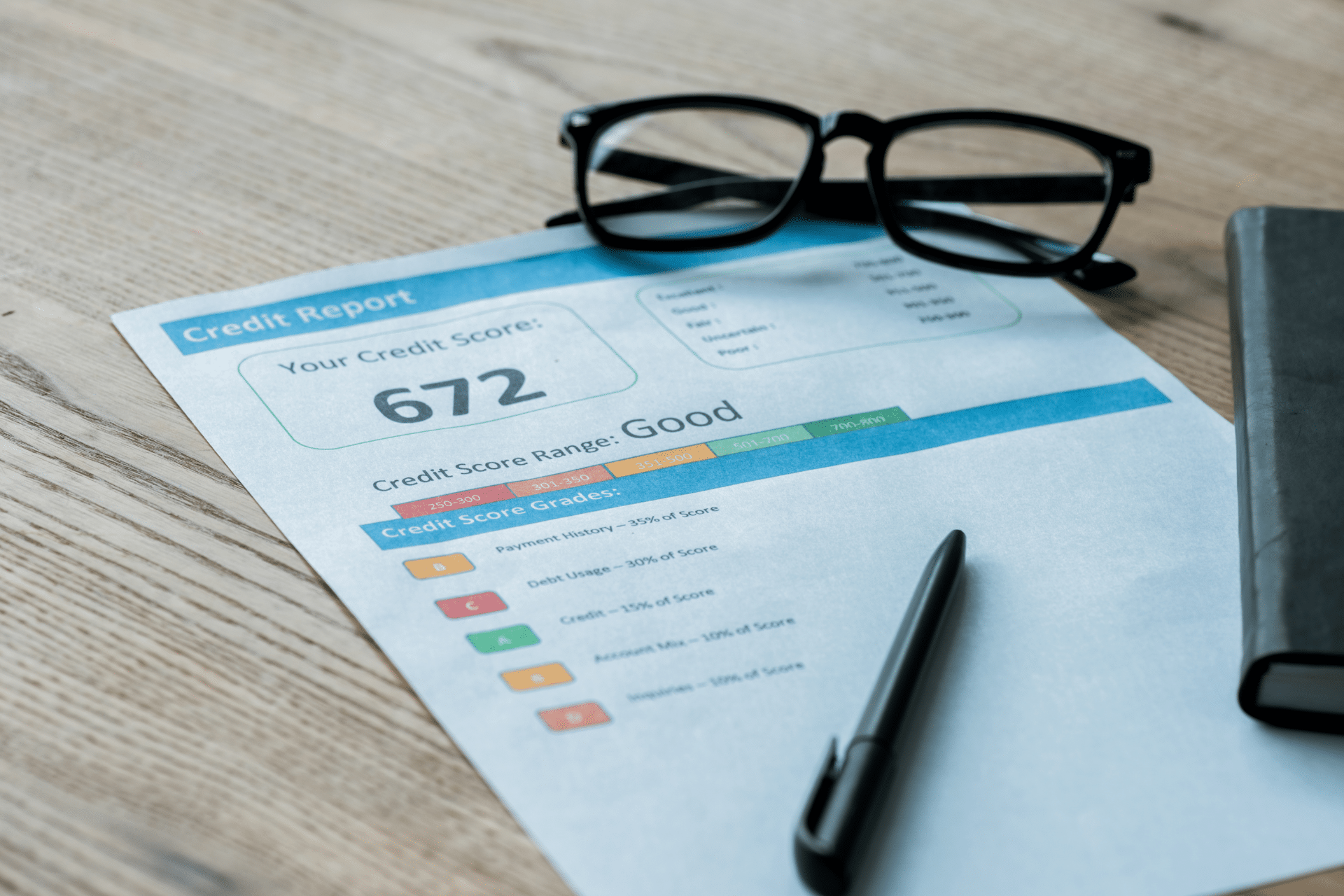

Your credit report is one of the most important tools in your financial toolkit. It provides a snapshot of your credit history, which lenders use to determine your creditworthiness. Understanding what’s included in your credit report and how to use it effectively is essential for maintaining a healthy financial life, especially when it comes to credit rebuilding in Alberta. In this article, we’ll break down the components of your credit report, explain their significance, and offer practical tips on how to use this information to your advantage.

What Is a Credit Report?

A credit report is a detailed record of your credit history, compiled by credit bureaus like Equifax and TransUnion. It includes information on your borrowing and repayment activities, such as loans, credit cards, and payment history. Your credit report is used by lenders, landlords, and even some employers to assess your financial responsibility.

Key Components of a Credit Report

Your credit report is divided into several sections, each providing different pieces of information about your credit history. Let’s take a closer look at each section.

Personal Information

The personal information section includes details such as your name, date of birth, Social Insurance Number (SIN), and address. This information is used to identify you and ensure that the credit report belongs to the correct individual.

- Tip: Ensure that your personal information, like address, phone number is accurate and up-to-date. Errors in this section can lead to misidentification which leads to decline in credit or even fraud.

Credit Accounts

This section lists all of your credit accounts, including credit cards, loans, and lines of credit. It details the type of account, the date it was opened, the credit limit or loan amount, and your payment history.

- Tip: Regularly review this section to ensure that all accounts listed are accurate. If you notice any unfamiliar accounts, report them immediately, as they could be signs of identity theft.

Public Records

Public records include any legal actions related to your finances, such as bankruptcies, liens, or judgments. These records can have a significant negative impact on your credit score.

- Tip: If you’ve been involved in any legal financial issues, make sure the information is accurate and reflects the current status. Incorrect or outdated records can unfairly lower your credit score.

Inquiries

When you apply for credit, the lender will check your credit report, resulting in an inquiry. There are two types of inquiries: hard and soft. Hard inquiries occur when a lender checks your credit for a loan or credit card application, and they can slightly lower your credit score. Soft inquiries occur when you check your own credit or when a lender checks your credit for pre-approval offers, and they do not affect your score.

- Tip: Limit the number of hard inquiries on your credit report. Multiple hard inquiries in a short period can signal to lenders that you are a high-risk borrower.

How to Use Your Credit Report for Credit Rebuilding

If you’re focused on credit rebuilding in Alberta, understanding your credit report is the first step. Here’s how to use this valuable tool effectively.

Monitor Your Credit Regularly

One of the best ways to rebuild your credit is by monitoring your credit report regularly. This allows you to track your progress, spot errors, and ensure that your efforts are paying off.

- Action Step:. There are agencies which allow you to monitor the credit report regularly. You are also allowed to have credit report for free once in a year from the Equifax and Transunion.

Address Any Negative Items

Negative items on your credit report, such as late payments or collections, can significantly impact your credit score. Addressing these items should be a priority.

- Action Step: If you have any negative items on your report, contact the creditor to discuss payment arrangements or dispute inaccuracies with the credit bureau.

Focus on Timely Payments

Your payment history is one of the most critical factors in your credit score. Ensuring that all your bills are paid on time will help improve your credit over time.

- Action Step: se Use calendar reminders to ensure you never miss a payment. If you are making manual payments, please ensure you are paying it at least 3 business days before the due date. If there are charges which you are contesting, it is advised that you pay first and then dispute.

Reduce Your Debt-to-Credit Ratio

Your debt-to-credit ratio, or credit utilization rate, is the amount of credit you’re using compared to your total credit limit. Keeping this ratio low is crucial for maintaining a healthy credit score.

- Action Step: Pay down credit card balances and avoid maxing out your credit limits.

The Role of Credit Counseling in Rebuilding Your Credit

Credit counseling services, such as those offered by 4 Pillars in Alberta, can be invaluable in helping you rebuild your credit. Credit counselors work with you to create a personalized plan to manage your debt, improve your credit score, and achieve financial stability.

- Action Step: Consider reaching out to a credit counseling service like 4 Pillars for professional guidance on rebuilding your credit.

How 4 Pillars Can Help

4 Pillars is dedicated to helping Canadians rebuild their credit and achieve financial freedom. Our credit counseling services provide personalized support to help you understand your credit report, address negative items, and create a plan for long-term financial success. Whether you’re dealing with debt in Edmonton or anywhere in Alberta, we’re here to help you every step of the way.

Ready to take control of your credit? Contact 4 Pillars today to learn more about how we can help you rebuild your credit score and achieve financial freedom. Don’t wait—start your journey towards a better financial future today!